Stock exchanges do command fees, so a company needs to be trading at a certain volume and price to make paying those fees worthwhile. Because the capital and other listing requirements for major exchanges are notoriously strict, a listing on one of the world’s biggest exchanges is prestigious and provides a company great visibility. Incentive stock options , which are given to executives, do receive special tax treatment.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Because of market makers, you’ll never have to wait to sell stocks at their full market value. You don’t need to wait until a buyer wants your exact number of shares — a market maker will buy them right away. The highest offer to buy shares listed from a market maker at any given time is known as the bid, and the lowest offered selling price is known as the ask. Companies listed on the stock market exchanges are regulated, and their dealings are monitored by the SEC.

Knowing how to make sound investment decisions can take the stress out of investing so you can focus on your long-term goals. Pulse Empowering companies to connect with their retail investors. When you’re ready for the public markets, we’ll create awareness for your brand’s mission, celebrate your entire team and create a day to remember. Running the NYSE demands unique leadership qualities, oversight of advanced data and technology, and the ability to preside over live broadcast events. NYSE President Lynn Martin takes the reins of an exchange off back-to-back record years for new listings and one positioned for a future where every company is a technology company. A transformation is the move to electronic trading to replace human trading of listed securities.

Motley Fool Returns

Get a better understanding of what https://forex-trend.net/s are and how you can incorporate them into your trading or investing strategy. The stock market is accessible to everyone, and there are two ways to own stocks. Stocks are also known as equities, which signifies that anyone who owns them has a stake in the company’s performance. Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Growth stocks tend to be riskier investments and generally do not pay dividends. Keep in mind that the price of a stock can fall as easily as it can rise. Investing in stock offers no guarantee that you will make money, and many investors lose money instead. Today, there are many stock exchanges in the U.S. and throughout the world, many of which are linked together electronically. Individual and institutional investors come together on stock exchanges to buy and sell shares in a public market.

In your neighborhood, you have a “supermarket” that sells food. The NYSE can be thought of as a big room where everyone who wants to buy and sell shares of stocks can go to buy and sell. One of the first considerations early investors make is how actively they want to manage their investing. Investors can open an online brokerage account if they plan to be completely hands-on. Some investors hire a financial advisor or money manager who can guide them through the process but will complete the actual buy and sell orders with the broker-dealers on the exchange. Some investors opt for a robo-advisor, which is a service provided by many brokerage firms that offers low-cost investment management, investing money based on specific goals.

In most developed countries, stock exchanges are self-regulatory organizations , non-governmental organizations that have the power to create and enforce industry regulations and standards. The NYSE was founded in 1792 with the signing of the Buttonwood Agreement by 24 New York City stockbrokers and merchants. Before this official incorporation, traders and brokers would meet unofficially under a buttonwood tree on Wall Street to buy and sell shares.

Shareholders

Stocks are traded on an exchange, and the value of these stocks can fluctuate over time. The currency in which the financial assets are denominated and the residence of those involved is national. The 2020 stock market crash was a major and sudden global stock market crash that began on 20 February 2020 and ended on 7 April. This market crash was due to the sudden outbreak of the global pandemic, COVID-19.

Mutual funds and ETFs allow investors to use a single purchase to invest in a pool of securities. Instead of buying individual stocks, you can buy into a wide range of holdings. If all your money is in one stock, industry or sector, an unexpected market dip could tank your portfolio. While popular, it’s an extremely risky investment approach that can lead to significant losses. Day traders actively buy and sell securities within the same day. The goal is to cash in on daily price movements in the stock market.

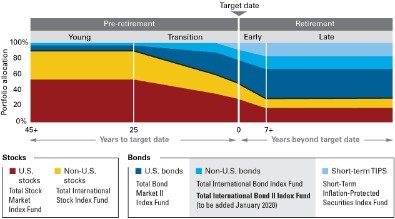

Morgan Advisor can help you understand the benefits and disadvantages of each one. Compare between 529 Plans, custodial accounts, financial aid and other education options to help meet your goals. Whether you prefer to independently manage your retirement planning or work with an advisor to create a personalized strategy, we can help. Rollover your account from your previous employer and compare the benefits of Brokerage, Traditional IRA and Roth IRA accounts to decide which is right for you.

How Do You Buy and Sell Stocks?

For example, if you set the price at $750,000, investors could expect a 10 percent return. If you set the price at twice that much, $1,500,000, investors would still get a respectable 5 percent return. The stock market can be intimidating, but a little information can help ease your fears. A share of stock is literally a share in the ownership of a company.

The secondary market is where investors buy and sell stocks (and other securities such as ETFs, ADRs, etc.). The term “stock market”, such as the New York Stock Exchange or the NASDAQ, is essentially a synonym for secondary market. In contrast to the secondary market, the primary market refers to the first time a security is created and sold to investors such as an initial public offering . In addition to buying stocks, many investors include bonds in their portfolios. To raise capital, corporations can also issue bonds, but buying one does not make you an owner.

- Please seek the advice of a qualified professional before making financial decisions.

- Those pieces of ownership are called stocks , and companies can list shares of their stock on stock exchanges where investors can buy them.

- Arielle has appeared as a financial expert on the “Today” show, NBC News and ABC’s “World News Tonight,” and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News.

Their buy or https://topforexnews.org/ orders may be executed on their behalf by a stock exchange trader. A stock exchange is an exchange where stockbrokers and traders can buy and sell shares , bonds, and other securities. Many large companies have their stocks listed on a stock exchange. This makes the stock more liquid and thus more attractive to many investors. These and other stocks may also be traded “over the counter” , that is, through a dealer. Some large companies will have their stock listed on more than one exchange in different countries, so as to attract international investors.

Let’s say your four years have elapsed, and you now have 20,000 stock options with an exercise price of $1. In order to exercise all of your options, you would need to pay $20,000 (20,000 x $1). Once you exercise, you own all of the stock, and you’re free to sell it. You can also hold it and hope that the stock price will go up more. Note that you will also have to pay any commissions, fees and taxes that come with exercising and selling your options.

Hence, their interest https://en.forexbrokerslist.site/ments run the risk of being lower than anticipated. Savannah Hanson is an accomplished writer, editor and content marketer. She joined Annuity.org as a financial editor in 2021 and uses her passion for educating readers on complex topics to guide visitors toward the path of financial literacy. A few simple steps used to be enough to control financial stress, but COVID and student loan debt are forcing people to take new routes to financial wellness. Stocks are a kind of financial instruments that gives the owner a fractional share of the issuing company. Yesterday, following the biggest decline of the year, the S&P 500 traded in a 1% range on either side of unchanged ending the session marginally lower.

In addition to the rise of the NASDAQ, the NYSE faced increasing competition from stock exchanges in Australia and Hong Kong, the financial center of Asia. Stock market’ is a broad term that encompasses a collection of markets where the regular buying, selling, and issuance of stocks in publicly held companies takes place. Please refer to Titan’s Program Brochure for important additional information. Before investing, you should consider your investment objectives and any fees charged by Titan. The rate of return on investments can vary widely over time, especially for long term investments.

Who Helps an Investor Trade on the Stock Market?

Listing requirements measure the size and market share of the security as a way of determining the company’s viability on their exchange. For instance, the New York Stock Exchange requires firms to have 1.1 million publicly traded shares with a market value of at least $100 million, and a minimum listing price of $4 per share. When you sell shares from ISO options, you will need to pay taxes on that sale. If you sell the shares as soon as you exercise them, the bargain element is regular income. If you hold the stock for at least one year after exercise AND you don’t sell the shares until at least two years after the grant date, the tax rates you pay are the long-term capital gains rates. When you decide to sell your shares, you will have to pay taxes based on how long you held them.

Connect with NYSE

The other type of stock exchange has a network of computers where trades are made electronically. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia.